And it’s worth a staggering £1,316,564, more than enough to buy him a new puncture repair kit. The new Chief Executive, Mr Charlie Nunn, is the only person in Lloyds Banking Group to get a 2020 group bonus payment, albeit based on what he would have earned at HSBC. When he joined, Lloyds granted him a ‘lost opportunity bonus award’ for the loss of his bonus from HSBC and that was announced within the last few days. No ‘lost bonuses’ have been awarded to any other member of staff.

Last week the Office for National Statistics confirmed that the retail price index (RPI) was 4.8% in August, up from 3.8% in July, its highest rate since December 2011. Now, we know that some of that increase, 0.4% according to the statisticians, can be attributed to the “eat out to help out” scheme last year but notwithstanding that, RPI inflation is going to remain persistently high for the rest of this year and into next year.

The overwhelming majority of Lloyds staff suffered a double whammy this year, due to probably the worst pay deal ever agreed by the in-house staff unions, of below inflation pay increases and no bonuses. The people running Lloyds looked after themselves and pocketed £millions bonus payments in the form of shares.

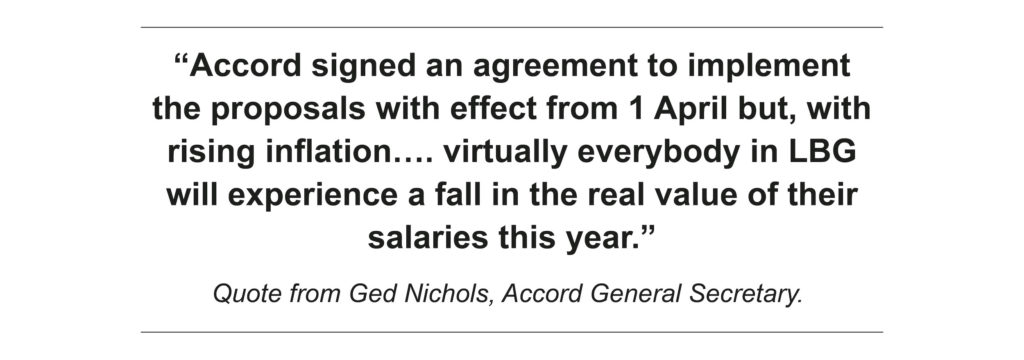

Just to recap, the average member of staff in Lloyds received a pay increase of just 1% in April 2021 but most of that will have been erased in a matter of weeks by spiralling inflation.

We know that the bank is refining its pay proposals for 2022 now. We would expect any pay pot, the total amount of money the bank spends on pay, to reflect increases in the cost of living. A pay pot below RPI, which is the true measure of inflation because it includes housing costs, should be unacceptable to any self-respecting trade union. Equally, the bank will try and play off bumper bonus payments against across-the-board salary increases for everyone. Again, that should also be rejected.

It is not asking too much for Lloyds staff, all of whom have made great efforts during the pandemic, to get a decent pay increase for once, especially when the bank is making so much money. Over to you, Charlie.

Members with any questions on this Newsletter can contact the Union’s Advice Team on 01234 262868 (Chose Option 1).